Secure Funding Fast with a Trusted Hard Money Lender Atlanta

Wiki Article

Accelerate Your Success: Enhance Growth With Our Unconventional Tough Cash Lending Alternatives

Aiming to enhance your business development and accelerate your success? Our non-traditional difficult cash loan options are here to help. With the benefits of quick approval and flexible terms, these loans can offer the financing you need to take your business to the next level. Discover the different sorts of difficult money lendings available and uncover just how to determine the right lender for your specific demands. Optimize your ROI and get rid of common challenges with our expert techniques. Get going on your path to success today.The Benefits of Tough Money Loans for Organization Development

Among the main benefits of hard money loans is their rate. Unlike traditional fundings that can take weeks or perhaps months to get approved, hard money fundings can be accepted in an issue of days. This fast turn-around time allows you to access the funds you need when you require them, allowing you to take possibilities and make calculated business decisions immediately.

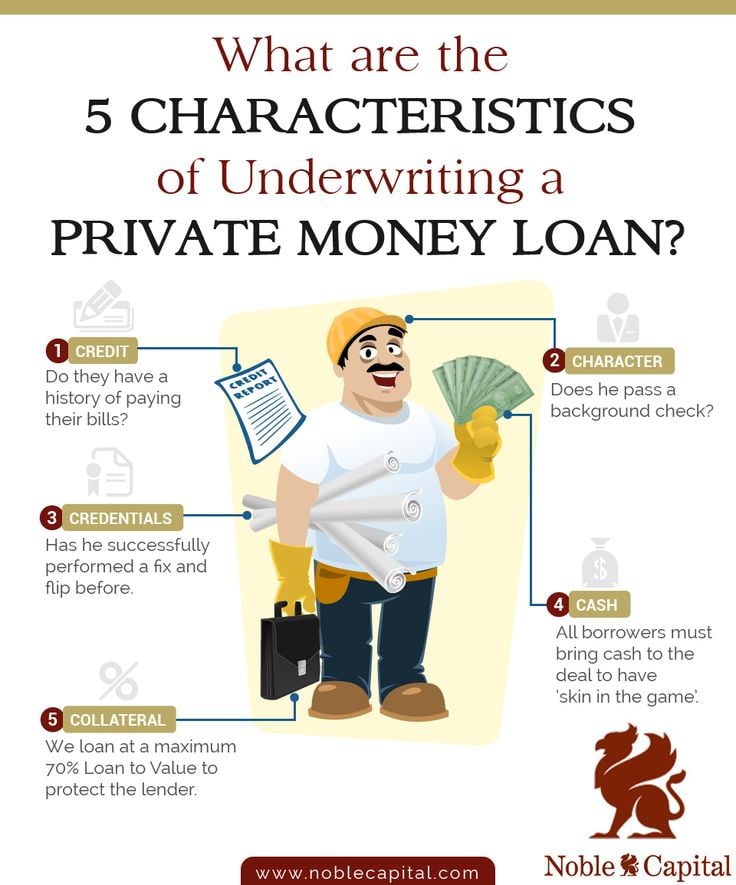

Another advantage of hard money finances is their adaptability. Standard loan providers frequently have strict standards when it involves financing authorization, making it tough for businesses with less-than-perfect debt or minimal collateral to secure funding. Hard money lenders, on the various other hand, concentrate more on the worth of the residential property being utilized as collateral, giving organizations with special situations a far better opportunity of authorization.

Additionally, hard cash finances provide a better loan-to-value proportion, implying you can obtain a larger percent of the residential property's value contrasted to standard car loans - hard money lender atlanta. This increased loaning power can offer the funding you need to broaden your operations, purchase brand-new devices, or employ additional staff to sustain your service development

Checking Out the Different Types of Non-traditional Difficult Cash Lendings

One type of unique hard money car loan is the bridge lending. Another kind of unusual tough cash finance is the repair and flip funding. Checking out these various kinds of non-traditional hard money car loans can open up a world of possibilities for your organization.How to Determine the Right Hard Cash Lender for Your Needs

When identifying the appropriate difficult money lender for your needs, it's essential to research their experience and track document in your details market. You want a loan provider that comprehends the unique difficulties and possibilities that exist in your field.

In addition to sector experience, it's critical to think about the lender's track document. Look for a lender with a tried and tested history of supplying on their guarantees and conference deadlines. hard money lender atlanta.

An additional essential aspect to take into consideration is the loan provider's problems and terms. Compare rates of interest, funding terms, and settlement alternatives from different lenders to discover the very best suitable for your demands. Make sure you fully understand the regards to the loan and any potential costs or fines.

Approaches for Making Best Use Of ROI With Tough Cash Car Loans

Conquering Common Challenges in Securing Difficult Cash Financings

Securing difficult money financings can be challenging, however there are approaches you can utilize to conquer usual obstacles. Among the most common challenges consumers face is the need for a considerable down payment. To conquer this, you can take into consideration partnering with a monetary investor that can offer the essential funds. One more obstacle is the brief repayment period commonly associated with difficult cash car loans. To conquer this challenge, it is critical to have a check this site out solid strategy in location for just how you will certainly have the ability to repay the finance within the offered duration. You can additionally explore alternatives for refinancing the car loan if required. In addition, the rigorous loaning standards of hard cash lenders can be a hurdle. try this To boost your opportunities of authorization, ensure to extensively examine and satisfy the lender's needs prior to applying. The lack of creditworthiness or a poor credit report background can make it hard to protect a difficult money loan. Nonetheless, you can overcome this by showing other types of security or assets that can be made use of to secure the financing. By utilizing these strategies, you can navigate the obstacles connected with safeguarding hard cash financings and enhance your opportunities of success.Verdict

So there you have it - by choosing unconventional hard money loans, you can increase your success and optimize growth for your organization. With the advantages they provide, such as quick authorization and flexibility, these financings can provide the boost you require to take your business to the following degree. By exploring the different kinds of hard cash loans readily available and determining the ideal loan provider for your requirements, you can make the most of ROI and overcome common obstacles. Do not think twice - take the opportunity for success with hard cash financings today.Discover the various kinds of hard money lendings readily available and find how to recognize the best lender for your details requirements. Unlike traditional loans that can take weeks or also months to get authorized, hard cash lendings can be accepted in an issue of days. One kind of unique hard cash lending is the bridge car loan. Another type of non-traditional tough money car loan is the repair and flip lending. By checking out the various kinds of tough money fundings offered and identifying the ideal lending institution for your requirements, you can make the most of ROI and get over common challenges.

Report this wiki page